Crypto Market Alerts: Real‑Time Intelligence for Traders, Analysts, and Institutions

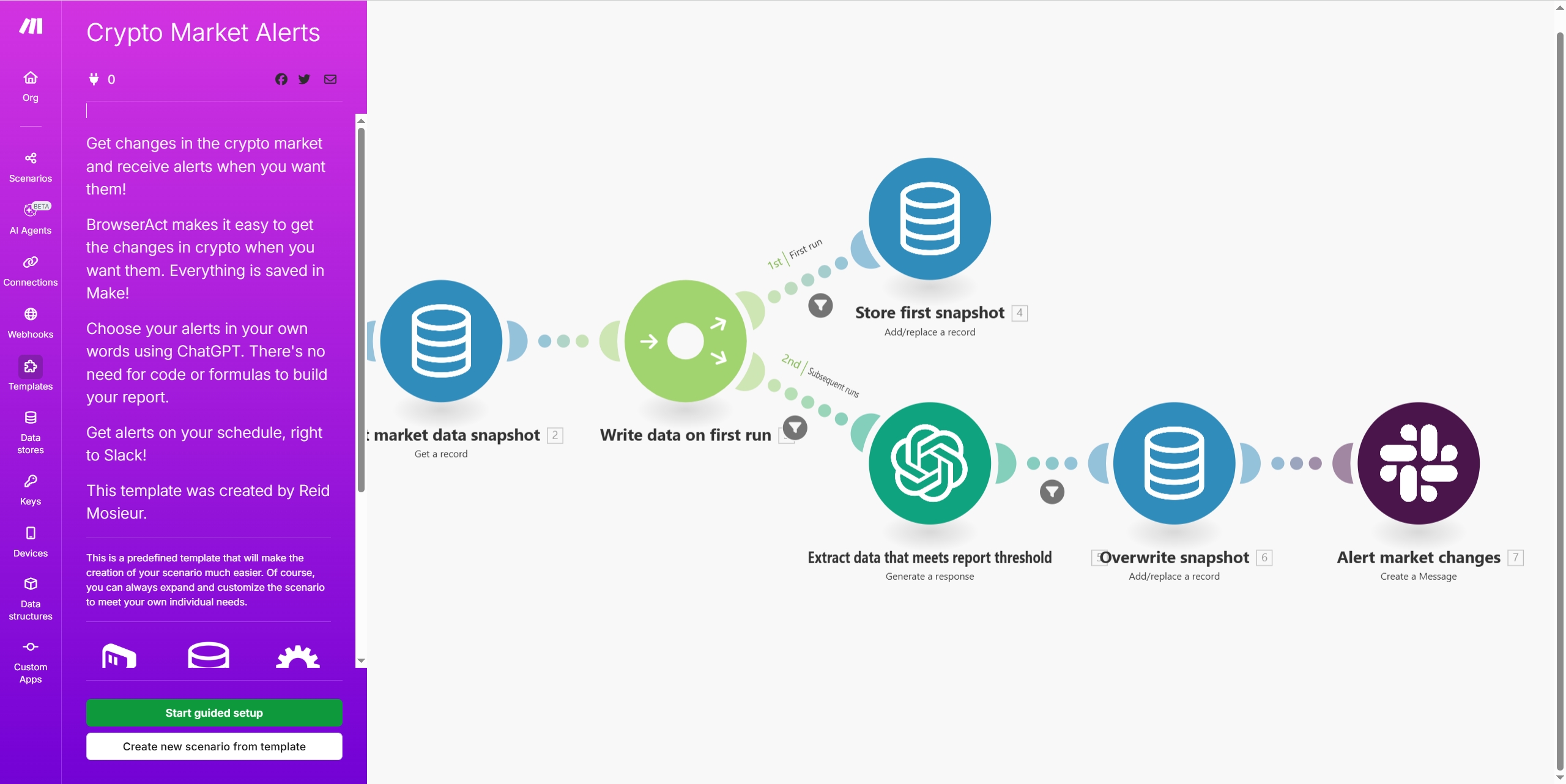

The article explores how AI‑powered crypto alerts revolutionize the way traders and analysts monitor the crypto market. It introduces the Crypto Market Alerts Workflow Template by Make and BrowserAct, an automated system that extracts live data from CoinMarketCap, analyzes it with AI, and sends real‑time crypto alerts via Slack.

If you’ve ever traded crypto, you know the struggle. The crypto market moves fast — sometimes swinging 5% up or down within minutes. Staying on top of every trade can feel impossible. Many traders spend hours refreshing charts, juggling multiple crypto trading apps, or reacting too late to market news. The result? Missed opportunities, emotional decisions, and lost gains.

That’s why smart crypto alerts are essential. They act as your AI crypto co‑pilot, constantly monitoring the crypto market and notifying you of key trends before others see them.

This guide introduces the best automated crypto‑alert system — our Crypto Market Alerts Workflow Template by Make and BrowserAct delivers everything — from real‑time data extraction and AI analysis to instant Slack notifications. Whether you’re managing your crypto portfolio tracker or actively trading, this workflow brings precision, speed, and control to your routine.

What are crypto alerts?

Crypto alerts are automated notifications that inform traders about important market movements, technical conditions, or economic events that may affect cryptocurrency prices. They act as an early‑warning system for traders, signaling when it might be time to buy, sell, or re‑evaluate a position. Three primary types of crypto alerts:

- Price alerts: Triggered when a coin moves by a certain percentage or a set number of points.

- Technical indicator alerts: Activated when technical tools such as RSI or Bollinger Bands meet a specified threshold.

- Economic result alerts: Generated before events like bank rate announcements or macroeconomic data that could influence crypto markets.

Crypto Market Buy Alerts

Buy alerts indicate it may be time to go long or close a short. They appear when a cryptocurrency shows bullish momentum, meaning its price is rising or likely to rise soon.

Crypto Market Sell Alerts

Sell alerts suggest it may be time to make profits or go short. They trigger when a coin’s momentum turns bearish, signaling potential price declines.

Examples of crypto alerts

Example of a buy alert might receive a buy alert when Ethereum’s price climbs above its 50‑day moving average, suggesting renewed upward momentum and a possible entry point for a long trade.

Example of a sell alert A sell alert could appear if Solana drops below a key trendline or its RSI falls under 40, indicating weakening momentum and a potential opportunity to open a short position or exit existing longs.

Alternatively, let’s suppose that the price of Ethereum drops below its 50‑day moving average after failing to hold recent support. You might decide to sell your long position or open a short trade, assuming that the downtrend could accelerate and push the price toward the next key support level.

Benefits of using crypto alerts

Crypto moves fast — prices rise or fall in minutes, not hours. That’s why smart alerts are your best ally. They keep you informed without the stress of constant chart‑watching.

With real‑time notifications, you’ll know exactly when prices shift, trends reverse, or technical signals appear — allowing you to react early and manage risk calmly.

Crypto alerts help you:

- Stay informed about key market movements

- Cut emotional trading and make decisions with clarity

- Save time through full automation

- Follow data‑driven strategies that boost your performance

Whether you trade Bitcoin, Ethereum, or emerging altcoins, crypto alerts ensure you never miss critical opportunities or warnings. They bring you accuracy, confidence, and control — helping you trade smarter in a market that never sleeps.

Core features of Crypto Market Alerts automation

Automated Market Data Extraction

The workflow begins with BrowserAct, which automatically visits CoinMarketCap and extracts up‑to‑date market table data. BrowserAct simulates real browsing behavior to accurately capture essential metrics such as cryptocurrency name, ticker, price, percentage changes, market cap, trading volume, and circulating supply — all in real time.

Smart Data Formatting & Cleaning

Before analysis, the raw data from BrowserAct is automatically formatted and cleaned. Prices are converted into numbers, percentage changes into decimals, and circulating supply into standardized numeric values — ensuring consistency, precision, and readiness for AI‑based analytics.

Historical Snapshot Comparison

Using Make.com, the workflow stores each data extraction as a snapshot and compares it with the previous run. This snapshot‑based comparison allows the system to detect significant shifts and evolving market trends across time.

AI‑Enhanced Metric Detection

An integrated AI engine analyzes differences between snapshots to identify meaningful market signals.

Trigger conditions include:

- Price movement greater than ±2%

- 1h change exceeding ±1%

- 24h change exceeding ±5%

- 7d change exceeding ±10%

- Market cap crossing key thresholds ($1T, $2T, $5T, etc.)

- Volume (24h) changes greater than 20%

- Ranking movement by 3 or more positions

- Rank crossing major tiers (Top 10, Top 50, Top 100)

Automated Alert Triggers & Notifications

Whenever conditions are met, the workflow instantly pushes Slack alerts to notify users of emerging market activity. This enables immediate response to critical developments without manual monitoring.

Continuous Data Updating

After every execution, the workflow overwrites the old snapshot with the latest one, maintaining an up‑to‑date dataset for continuous tracking and historical analysis.

Zero‑Input, Fully Automated Workflow

No manual steps are required at any stage. BrowserAct handles web data extraction, Make.com manages automation and snapshot storage, and the AI engine conducts metric comparison and alert generation — forming a complete end‑to‑end automated crypto alert system.

What can you benefit from the Crypto Market Alerts automation

Staying ahead in crypto often comes down to timing. The Template helps you stay one step ahead — with automation that feels like having a professional analyst watching the markets for you 24/7. Through BrowserAct’s real‑time data extraction, AI‑driven analysis, and Make.com’s seamless automation, this system:

- Cuts manual tracking time by over 90%

- Eliminates repetitive errors that come from human monitoring

- Delivers verified data in seconds whenever the market shifts

Studies show traders who respond within the first 5 minutes of a major market move can improve profitability by 15–20%. Yet most miss this chance because updates arrive too late, or there’s too much noise. This workflow quietly handles that for you. It continuously scans hundreds of top coins and highlights moments that matter — like:

- Price swings greater than ±2%

- Volume surges above 20%

- Market‑cap jumps crossing $1 trillion or more

All alerts are sent instantly via Slack, keeping you informed without constant chart‑watching.

Real‑World Use Cases

Active Crypto Traders|Stay Ahead of Every Market Shift

For traders who live by the charts, timing is everything. This workflow becomes your personal assistant, watching the market every second and alerting you only when it truly matters.

- Detect price spikes and corrections instantly with BrowserAct’s live data fetch.

- Act within seconds of critical movements — capturing short‑term gains others miss.

- Set precise thresholds (±2% price shifts, 20% volume changes, etc.) that matches your trading strategy.

- Avoid information overload by focusing only on verified, high‑impact alerts.

Portfolio Managers & Investment Analysts|Data‑Driven Market Intelligence

For professional investors juggling multiple assets, this workflow acts as an intelligence dashboard that never sleeps.

- Track market‑cap re‑rankings and sector correlations in real time.

- Use historical snapshots to detect emerging trends before they go mainstream.

- Generate automated weekly and monthly reports without manual exports.

- Make allocation decisions based on data‑verified performance metrics, not guesswork.

Research Teams, Crypto Media & Analysts|Simplify Data Collection

If your work depends on market summaries, this workflow is your automated data engine.

- Extract structured JSON data directly from CoinMarketCap for clean analysis.

- Identify headline‑worthy movements — huge caps, 24 h surges, or ranking jumps.

- Feed your newsroom or analytics dashboard with automated daily highlights.

- Build insights faster with ready‑to‑use, consistently formatted datasets.

Institutional Risk & Compliance Teams|Real‑Time Oversight, Zero Blind Spots

Institutions face higher stakes — a delayed response can mean millions.

This workflow offers a consistent layer of oversight and risk monitoring powered by automation.

- Detect significant volatility events or volume anomalies automatically.

- Build custom alert rules aligned with internal treasury or compliance protocols.

- Receive fast alerts to support hedging, custody, and risk‑adjustment decisions.

- Maintain a documented trail of market conditions over time for audits or reporting.

Data Engineers & Automation Builders|Integrate and Innovate

For technical teams, this template is both a ready‑to‑use product and a flexible data backbone.

- Use BrowserAct’s structured output to feed data pipelines and dashboards.

- Connect with other Make.com workflows or external APIs for advanced automation.

- Build predictive trading models or AI agents powered by verified market data.

- Customize outputs for DLT analytics, DeFi monitoring, or competitive benchmarking.

Education & Training Platforms|Teaching Real‑World Crypto Analytics

For educators and training providers, this workflow is a perfect demonstration of practical, hands‑on automation in crypto data science.

- Teach how professional workflows extract, clean, and analyze live market data.

- Show students or clients the full process — from web scraping to AI‑based signal detection.

- Use it to simulate professional trading operations and demonstrate risk management automation in real time.

Stay ahead of the crypto market with AI‑powered crypto alerts. The Crypto Market Alerts Workflow by Make and BrowserAct automates real‑time data tracking, AI analysis, and instant Slack notifications — letting traders and analysts monitor prices, trends, and portfolios effortlessly in 24/7 crypto trading.

Start automating your crypto market today!

Relative Resources

From Reviews to Strategy: Using Sentiment Analysis for Market Analysis and Product Research

Automate News Tracking and Content Updates with AI

Using Amazon Competitor & Review Sentiment Scraper to Outperform Rivals

Twitter/X to Telegram AI Automation — Smart Social Media Dashboard

Latest Resources

Moltbook: Where 150K AI Agents Talk Behind Our Backs

How to Bypass CAPTCHA in 2026: Complete Guide & Solutions

Moltbot (Clawdbot) Security Guide for Self-Hosted AI Setup