Jungle Scout vs. Helium 10: What Real Sellers Are Saying in 2025

Discover the key differences between Jungle Scout and Helium 10 in this in‑depth comparison. Learn about data accuracy, pricing, features, and seller feedback to choose the right product research tool for Amazon FBA in 2025.

Imagine you are preparing to launch your next product on Amazon. You spend late nights digging through categories, checking bestseller lists, and comparing reviews in search of that one product with real potential. To make the process easier, you invest in a well‑known research tool—Jungle Scout or Helium 10. At first, the dashboards look impressive and the charts seem to point you in the right direction.

But after a few weeks, reality sets in. The sales numbers on your own account do not match the estimates. The trends that looked promising in the tool do not translate into real order. And when you read through Reddit and Quora, you realize you are not alone—many sellers are voicing the exact same frustrations.

This article takes a closer look at Jungle Scout and Helium 10. We will compare their key features, highlight the strengths, and expose the shortcomings, drawing not just from marketing promises but from what real sellers have experienced over the past year.

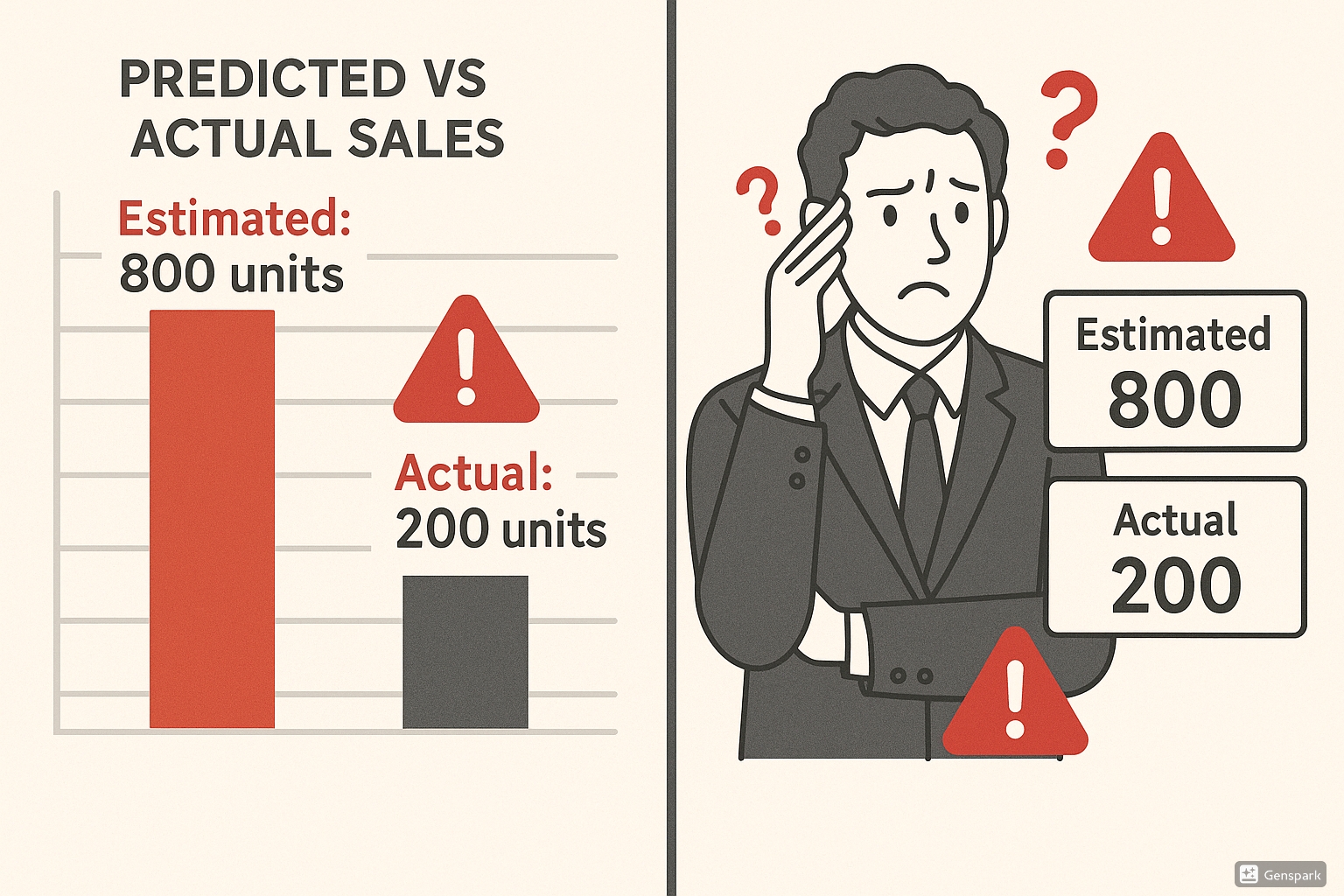

Data Accuracy: The Heart of the Debate

How tools generate numbers

- Jungle Scout relies primarily on Amazon’s Best Seller Rank (BSR), applying internal algorithms to estimate monthly sales figures.

- Helium 10 uses a broader dataset combined with machine learning, but still fundamentally depends on sales rank and estimation models.

What sellers say (from Reddit and Quora):

- “Jungle Scout says an item sells 800 units a month. In reality, my sales barely reach 200.”

- “Helium 10 data is closer sometimes, but still swings wildly depending on category.”

- “When I cross‑check the same ASIN in both tools, the numbers are completely different. How can I trust either?”

- “Niche categories like handmade or seasonal sales are basically impossible to analyze correctly.”

Analysis:

Both platforms can provide rough directional hints, but neither offers guarantees of real sales numbers. This uncertainty often leads to misinformed inventory decisions—sellers report overstocking due to inflated estimates, or missing opportunities because the tools understated demand.

👉 Verdict: Estimates are educated guesses, not reliable evidence.

Platform Coverage: Bound to Amazon

Jungle Scout

- Focuses almost entirely on Amazon.com (U.S.) with some limited expansion to other Amazon marketplaces.

- Recently added tools for Walmart, but functionality remains narrow.

Helium 10

- Offers broader tools within Amazon ecosystems, including marketplaces outside the U.S., and some Walmart support.

- Still restricted to platforms where Amazon provides data.

Seller feedback:

- “I sell on Shopee and Lazada, but Jungle Scout and Helium 10 do not support these markets at all.”

- “I wanted to analyze an upcoming trend that started on Shopify stores, but there was nothing in the database.”

- “Outside of Amazon, these tools are basically useless.”

👉 Verdict: Both tools remain Amazon‑centric. They are helpful if you are an FBA seller only, but irrelevant if you sell across multiple platforms

Pricing and Value for Money

Jungle Scout pricing

- Usually ranges from $49 to $129 per month depending on the tier.

- Offers lifetime plans for specific modules, but with limited functionality.

Helium 10 pricing

- The wider range from $39 to $229 per month.

- Higher tiers include advanced analytics, PPC management, and more.

Seller feedback:

- “Helium 10 at $99 per month feels very steep considering the inaccuracies.”

- “Jungle Scout forces me to upgrade to access features I barely use.”

- “I end up paying for both tools to compare data, but spending hundreds still leaves me guessing.”

👉 Verdict: Subscription cost is high, especially when accuracy is questionable. Many sellers feel ROI does not justify the expense.

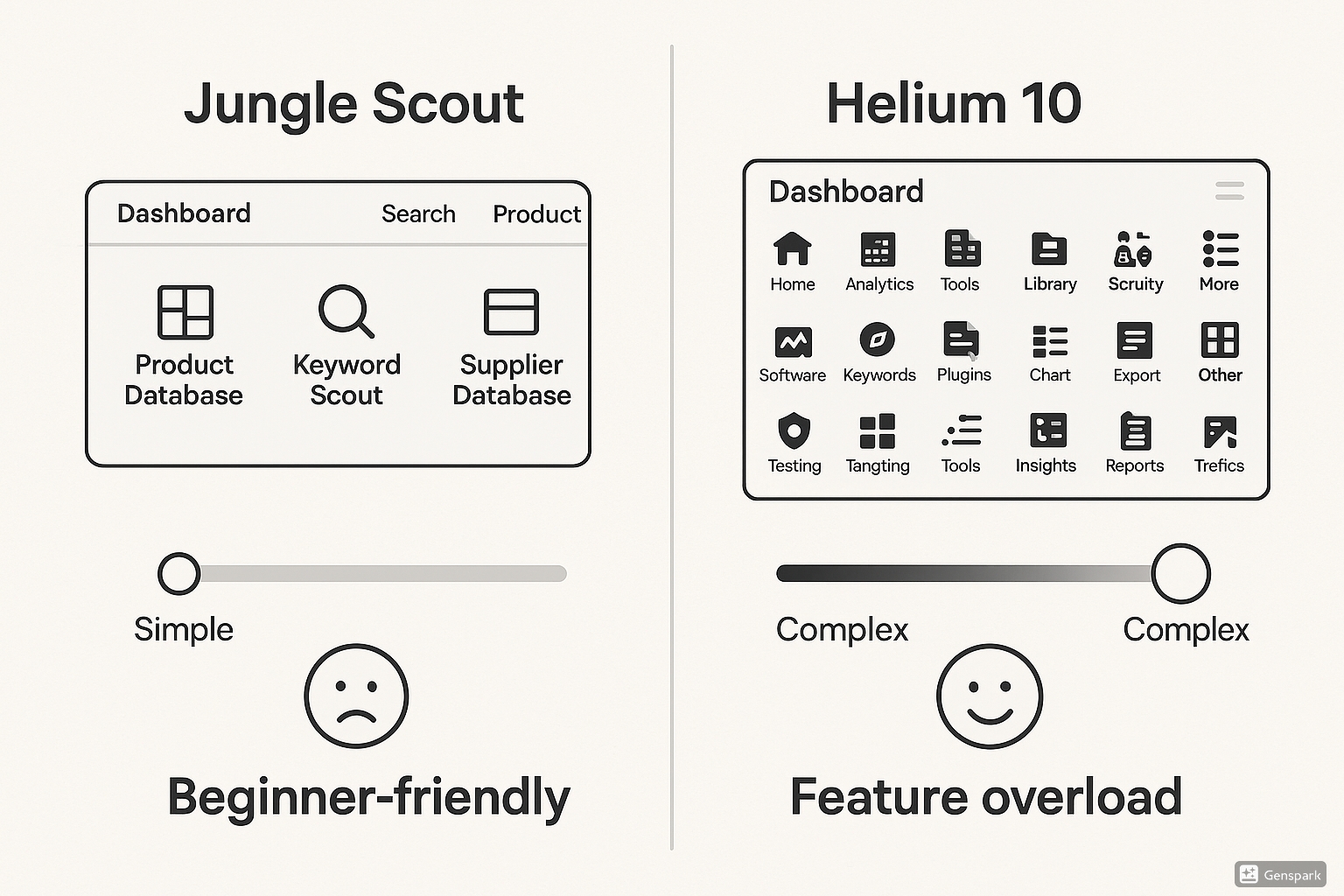

Features, Depth, and Usability

Jungle Scout strengths:

- User‑friendly interface, suitable for beginners.

- Focused product database, opportunity finder, and keyword tracker.

- Simplified dashboard with fewer tools, lower learning curve.

Jungle Scout weaknesses:

- Limited analytics depth—often considered shallow for advanced sellers.

- Fewer features for advertising optimization, profit tracking, or advanced automation.

Helium 10 strengths:

- Very comprehensive: over 20+ individual tools, including keyword research (Cerebro, Magnet), listing optimization, profitability calculators, refund tools, and PPC campaign management.

- Considered an “all‑in‑one” ecosystem.

Helium 10 weaknesses:

- Overwhelming for new users.

- Many sellers report using no more than 20–30% of the suite.

- Steep learning curve, cluttered interface.

Seller feedback:

- “Jungle Scout is too basic — I quickly grew out of it.”

- “Helium 10 is powerful but honestly exhausting. I pay for 20 tools and only use 3.”

👉 Verdict: Jungle Scout is better for beginners, but lacks power later on. Helium 10 is comprehensive but overwhelming.

Real‑Time Performance: Missing Speed

How they work now:

- Both update data daily or weekly.

- They cannot track true real‑time results.

Pain points sellers raise:

- Promotional activity, such as Prime Day or 11.11, gets counted as if it were normal sales.

- Fake orders or artificial boosts look like real customer demand.

- By the time keyword rankings update, competitors often already adjusted.

👉 Verdict: Jungle Scout and Helium 10 cannot reflect real‑time conditions, which is a severe limitation when markets move fast.

Overall Community Perception

Across online discussions, a few consistent themes appear:

- Accuracy confusion: “Neither Jungle Scout nor Helium 10 can be trusted 100%; use both to cross‑check.”

- Cost frustration: “I am spending hundreds per month for tools that still guess.”

- Amazon lock‑in: “The tools stop being useful if you want to validate other platforms.”

- Feature overload: “Helium 10 feels bloated; Jungle Scout feels underpowered.”

Typical seller conclusion:

“I use both tools, compare results, but at the end of the day I am still guessing.”

Feature / Aspect | Jungle Scout | Helium 10 | Seller Verdict |

Data Accuracy | Relies heavily on BSR and estimates | Uses larger dataset but still estimate‑based | Both are inconsistent and unreliable |

Platform Coverage | Amazon U.S. + some Walmart | Amazon (multiple markets) + partial Walmart | Amazon‑only; cannot track Shopee, Lazada, eBay, Shopify |

Pricing | $49–$129/month | $39–$229/month | Considered expensive vs. trust gained |

Usability | Simple, beginner‑friendly | Advanced, but overwhelming with 20+ tools | One is too simple, the other too complex |

Real‑Time Update | Daily/weekly refresh | Daily/weekly refresh | Both miss fast shifts and promotions |

Best Fit | Beginners focusing on Amazon | Advanced Amazon sellers seeking full suite | Neither solves data trust problem |

From Estimates to Evidence: The Real Challenge and a New Direction

The biggest limitation with both Jungle Scout and Helium 10 is not their interface design, pricing tiers, or the number of tools they bundle. It is the fact that everything rests on estimates. Both platforms extrapolate sales using algorithms tied to Amazon’s Best Seller Rank. They cannot provide authentic sales data or capture what is happening in real time.

This explains why so many sellers echo the same frustration online:

“I am paying for estimates, not reality.”

A growing number of sellers are now asking a different question: What if, instead of paying for models, we could directly access real, live market evidence?

That is where BrowserAct comes in. Rather than relying on internal assumptions, Browseract simulates actual browsing behavior to collect exact product information directly from e‑commerce websites.

- Real data, not guesses: Prices, stock levels, reviews, rankings—all fetched as they really are in the moment.

- Across all platforms: Amazon, Shopee, Lazada, eBay, Shopify, WooCommerce, and more.

- Flexible and transparent: Data can be sent into Google Sheets, Airtable, or your own databases for custom dashboards.

- Built for automation: Compatible with tools like Make or n8n to trigger alerts, track competitors, or generate tailored reports.

👉 Instead of juggling costly subscriptions for uncertain estimates, Browseract offers sellers the freedom of direct evidence—moving decisions from speculation to clarity.

Conclusion

Jungle Scout and Helium 10 remain the most recognized names in the Amazon seller toolkit, but their shared reliance on estimate‑based data models leads to recurring frustrations—uncertain accuracy, limited platform scope, and high subscription costs. Sellers often find themselves paying premium prices for numbers that don’t fully reflect real‑world sales.

This is where BrowserAct takes a different path. Unlike tools built on assumptions, BrowserAct captures live, real data directly from product pages, works across multiple platforms (Amazon, Shopee, Lazada, eBay, Shopify, and more), and delivers results in real time. Instead of locking sellers into fixed dashboards, it lets them export and automate freely—shifting decisions from guesswork to evidence.

👉 In short: while Jungle Scout and Helium 10 give you a model of the market, BrowserAct shows you the market as it really is.

Relative Resources

Best AI Search Engines in 2025 — Which One Fits Your Needs?

Best SMS Apps in 2025: The Ultimate Guide to Smarter Texting

Best Font Generator: How to Transform Your Text Into Creative Magic

The Ultimate Guide to AI Email Tools: Are You Missing Out?

Latest Resources

Moltbook: Where 150K AI Agents Talk Behind Our Backs

How to Bypass CAPTCHA in 2026: Complete Guide & Solutions

Moltbot (Clawdbot) Security Guide for Self-Hosted AI Setup