How to Automatically Find Investment Opportunities from Funding News

This guide shows how to build an automated startup funding tracker that discovers recently funded companies within 6 hours of announcements—24-48 hours faster than competitors. The 4-stage workflow uses BrowserAct to scrape TechCrunch, N8N for intelligent processing, Gemini AI to extract company details and investment purposes, and delivers real-time alerts to Google Sheets. Designed for VCs, sales teams, recruiters, and analysts who need early access to investment opportunities before deal flow becomes competitive. Manual monitoring wastes hours and delivers outdated results; this system runs automatically every 6 hours without expensive database subscriptions.

Introduction

Finding high-quality investment opportunities before your competitors do is the difference between closing deals and chasing cold leads.

But if you're a VC, angel investor, or sales professional targeting funded startups, you already know the problem: by the time you discover a company just raised $20M, 50 other people already reached out.

The traditional approach looks like this:

You manually check funding databases every few days. You set up Google Alerts that flood your inbox with irrelevant news. You subscribe to $49/month platforms that update 2-3 days after announcements go public. You spend 6-8 hours per week reading articles, copying company names into spreadsheets, and researching context—only to realize the founder's calendar is fully booked because you're the 47th person to send a "congrats on the raise" email.

Meanwhile, the Series B SaaS company that announced funding yesterday mentioned they're "hiring 40 engineers" and "launching an enterprise product in Q3." That's the exact investment opportunity your recruiting firm needed—but you found it 72 hours late.

What if you could discover funding opportunity announcements within 6 hours of publication instead of 3 days?

In this guide, you'll learn how to invest in startups more strategically by building a fully automated system that monitors multiple news sources for funding opportunity announcements, uses AI to extract investment details, filters out noise through intelligent lead qualification, and delivers actionable leads to your team before anyone else even knows these companies exist.

Quick view → How to find funding opportunities?

This isn't theoretical. Investment firms and sales teams using this approach discover investment opportunities 24-48 hours faster than competitors. Some close 3-5 deals per quarter directly from automated lead pipelines. Others build proprietary market intelligence on funding opportunity announcements that would cost $15,000+ annually from data vendors.

How do Investors Find Investment Opportunities

The deal pipeline and how it works

In venture capital, finding startups isn't random — it follows the deal flow pipeline principle. This system structures the entire process, from initial contact to actual investment, helping investors evaluate potential companies methodically when searching for investment opportunities.

Hundreds, sometimes thousands, of startups enter the pipeline each year. They arrive from conferences, recommendations, accelerators, and direct approaches. Investors quickly eliminate those that don't fit their strategy, keeping only the most promising investment opportunities.

Stage 1: Deal Sourcing – Casting the Widest Net

Companies flood in from everywhere: warm introductions from other founders, networking at TechCrunch Disrupt or Web Summit, accelerator demo days, cold emails from founders who researched the fund's thesis, and automated monitoring of funding opportunity announcements in news sources.

A mid-sized VC fund might see 1,000-2,000 investment opportunities enter this stage annually. Volume is high, filtering is minimal.

This is where learning how to invest in startups becomes systematic rather than sporadic. Professional investors don't wait for deals to find them—they build channels that deliver consistent deal flow.

Stage 2: Screening – Rapid Lead Qualification

Here, the main parameters get evaluated: industry fit, development stage, team background, and market potential.

Does the startup operate in sectors the fund targets? A climate tech fund passes immediately on fintech deals. Is the company at the right stage? Pre-seed funds don't touch Series B companies. Does the market support venture-scale returns? Investors want $1B+ addressable markets minimum.

Up to 70-80% of companies get eliminated at this stage. Not because they're bad businesses, but because they simply don't align with the fund's focus. A partner spends 5-10 minutes per company reviewing pitch decks. This is lead qualification at scale.

Here's where timing creates advantage when discovering investment opportunities: If you're tracking funding opportunity announcements automatically, you reach founders before they've been screened out by 15 other funds. You're not the 47th congratulatory email—you're one of the first three.

This early contact transforms how to invest in startups from a reactive process into a proactive one.

Stage 3: Deeper Evaluation – Assessing Team and Product

If a company looks promising, an initial meeting happens with the founders. It's important at this stage not only to see the presentation, but also to assess the energy and competence of the team.

Can they articulate their vision clearly? Do they understand unit economics? Have they thought through competitive positioning?

Product demos reveal differentiation and technical depth. Reference calls with customers or former colleagues validate execution ability. Investors evaluate not just what founders say, but how they think through problems.

Roughly 20-30% of screened companies make it this far.

Practical insight for sales and recruiting teams: Companies in active investor conversations—identifiable through funding opportunity announcements mentioning "closing their round" or "in talks with VCs"—are 6-12 weeks from having fresh capital and urgent hiring needs. This is effective lead qualification for B2B outreach.

Stage 4: Due Diligence – Thorough Verification

This involves a thorough check: business finances, legal documents, customer base, technical architecture, competitive landscape. The investor wants to ensure the company is transparent and poses no hidden risks.

Financial analysis examines revenue growth, burn rate, runway, and customer concentration. Legal review covers cap table structure, IP ownership, and regulatory compliance. Customer validation means direct conversations with 5-10 buyers to confirm value proposition and retention likelihood.

This stage takes 2-8 weeks. Only 5-10% of companies that entered the pipeline make it here.

The timing advantage: By the time a company appears in Crunchbase—which updates 48-72 hours after funding opportunity announcements—they might already be in due diligence with three other funds. Real-time monitoring lets you reach out during screening or evaluation, before competition intensifies. This is the practical advantage of understanding how to invest in startups with automated deal sourcing.

Stage 5: Term Sheet and Closing – Final Negotiation

This document outlines the key terms: investment amount, valuation, equity stake, board composition, protective provisions, and liquidation preferences. If both parties agree, preparations for final closing begin.

Only 1-3% of deals that entered the pipeline receive investment. This is normal—funds deliberately invest in very few companies, but give them maximum attention. The deal funnel systematizes the process and ensures no truly valuable investment opportunities are missed.

Search Tools Investors Use to Find Investment Opportunities

Investors actively use various tools to identify promising startups. These can be categorized as public, professional, and proprietary sources.

Public Sources: Conferences and Industry Events

Conferences and exhibitions are market classics. Events such as Web Summit, Slush, TechCrunch Disrupt, and Collision bring together thousands of entrepreneurs and hundreds of investors.

Startups get the chance to present themselves on stage or in demo zones, and investors can see live products, meet teams, and experience the founders' enthusiasm. The advantage is live interaction—assessing founder energy, team dynamics, and product polish in person. The disadvantage is geographic and time constraints: you can only attend 4-6 major events annually, meaning you miss 95% of investment opportunities.

Niche industry events (Climate Tech Summit, Fintech Festival, AI & Big Data Expo) provide more targeted deal flow for sector-focused investors. If you're learning how to invest in startups in a specific vertical, these gatherings concentrate relevant investment opportunities in one place.

Professional Networks: Investment Clubs and Syndicates

Investment clubs are associations of private investors who analyze deals together and decide where to put money. They're particularly popular among business angels, as they enable them to share experiences and mitigate risks through collective decision-making.

Members typically review 2-5 deals per month collectively, conduct group due diligence sessions, and make independent investment decisions. This reduces individual workload through collective lead qualification—if 10 members each source 2 deals monthly, everyone evaluates 20 investment opportunities instead of 2.

Investor syndicates are more structured. An experienced lead investor analyzes the deal, negotiates terms, commits their own capital, and invites syndicate members to invest alongside them at the same terms. This mechanism is popular on AngelList and gives less experienced investors access to high-quality deals.

Syndicate members gain access to vetted investment opportunities without conducting full due diligence themselves. The lead investor typically receives carried interest (15-20% of profits) for their work.

Structured Programs: Accelerators and Incubators

Investors often collaborate with accelerator programmes to gain access to the latest startups. Getting into an accelerator programme is a quality filter in itself.

Top-tier accelerators (Y Combinator, Techstars, 500 Global) are powerful deal sources because getting into YC (1-2% acceptance rate) signals founder quality and idea merit. Demo days present 50-100 startups simultaneously, concentrating investor attention. Many VCs build relationships with accelerator partners to see companies before public demo days.

Industry-specific incubators (IndieBio for biotech, Barclays Accelerator for fintech) work similarly but focus on vertical expertise rather than general startups.

For investors outside these networks, tracking accelerator demo day funding opportunity announcements (e.g., "YC W25 Demo Day: 20 AI Startups to Watch") provides a curated list of investment-ready companies and effective lead qualification starting points.

Digital Platforms: Online Databases and Analytics Tools

Professional investors subscribe to multiple data platforms for discovering investment opportunities

- TechCrunch (free) is the industry's most-read startup news source. Most funding opportunity announcements appear here first—often 12-48 hours before they're indexed in databases. Investors monitor daily for early signals, but manually checking 30-50 articles requires significant time.

- Crunchbase Pro ($49-99/month) tracks funding rounds, acquisitions, and leadership changes with filters for stage, industry, and geography. Updates 24-72 hours after news breaks.

- PitchBook ($10,000+/year) provides institutional-grade data with private company financials, investor portfolios, and market analysis. Used by VCs and PE firms.

- Dealroom ($500-5,000/year) focuses on European early-stage startups with ecosystem maps and investor league tables.

- AngelList (free for investors) enables direct startup discovery with filters for stage, market, and traction metrics. Includes syndicate functionality.

- Signal (free with NYT subscription) aggregates startup news and funding opportunity announcements from major publications.

- Harmonic (invite-only) uses AI to learn investor preferences and suggest relevant companies.

Free tools like TechCrunch require manual daily monitoring. Expensive tools ($10K+/year) update 24-72 hours after news breaks. Most platforms show companies that already raised funding, not companies about to raise—which means you're following rounds instead of leading them.

This is the gap automation solves. While manual monitoring takes 2-3 hours daily and databases lag by days, automated systems can check TechCrunch and 20+ sources every 6 hours, extract relevant investment opportunities, and alert you within minutes of publication.

In the next section, we'll build exactly this system: a 4-stage workflow (focus on TechCrunch) that monitors funding opportunity announcements automatically, performs intelligent lead qualification, and delivers actionable alerts—replicating how professional investors find investment opportunities without the manual labor or expensive subscriptions.

Building an Automated System to Find Investment Opportunities

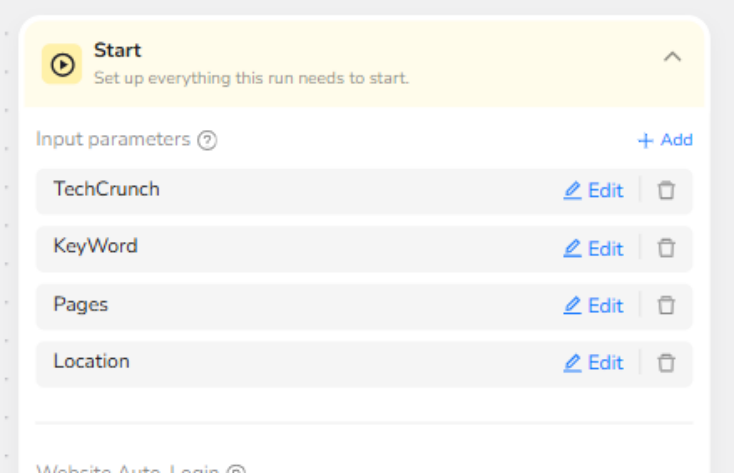

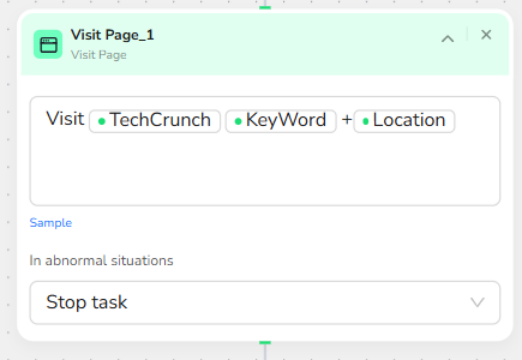

Part 1: Data Collection with BrowserAct

The first stage focuses on systematically gathering raw article data from TechCrunch.

Click to view our Official Template!

- Configuration: Set target keywords ("funding," "raises," "Series A"), location filters, and page depth (3-5 pages).

- Execution: Automated navigation to TechCrunch search results — no manual browsing.

- Extraction: Systematic loop capturing article URLs and full text from 50-100 articles per keyword.

- Result: Complete dataset of potential investment opportunities collected in minutes, not hours.

This automation handles the manual work of monitoring funding opportunity announcements across multiple search terms simultaneously—the foundation of scalable lead qualification.

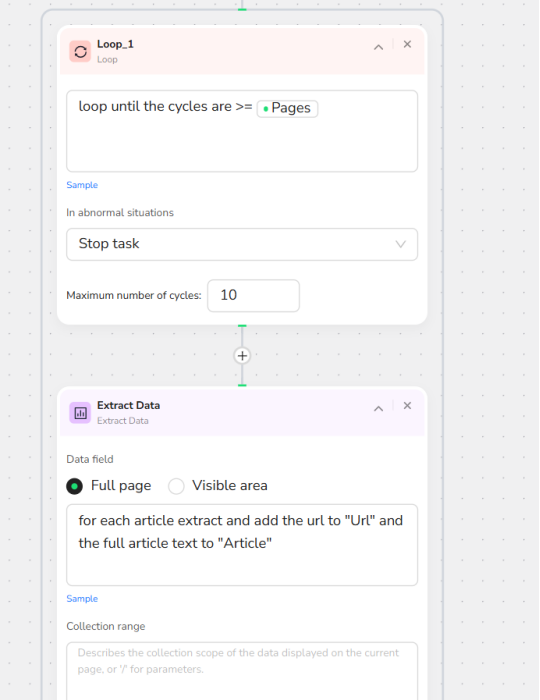

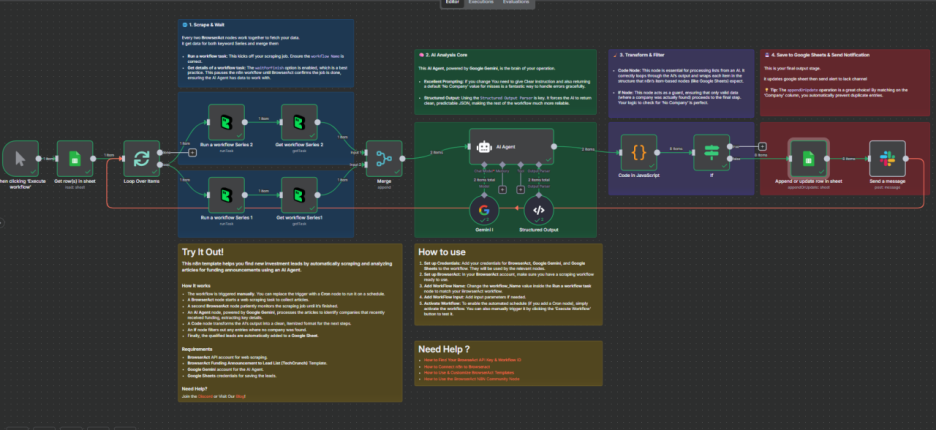

Stage 2: Intelligent Processing with N8N

Once scraping completes, N8N processes the data:

- Input source: Google Sheet containing keyword series and location filters—easily updated without code changes.

- Parallel execution: Two simultaneous searches per row, then merged results reduce AI false positives.

- Trigger mechanism: BrowserAct workflow activates automatically, waits for completion, pulls data into N8N.

Processing multiple keywords in parallel means discovering investment opportunities 3-4x faster than sequential searches. If both keyword searches identify the same company, it's a stronger signal of genuine funding opportunity announcements. This parallel approach is critical for anyone learning how to invest in startups at scale—you're evaluating 100+ articles while competitors manually scan 20.

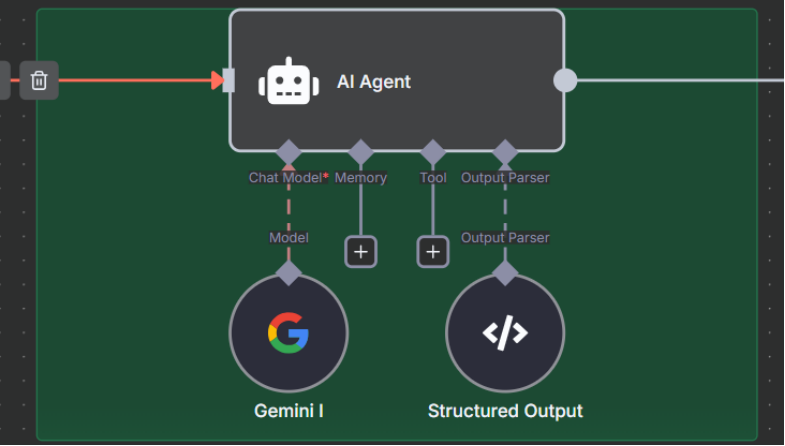

Stage 3: AI-Powered Extraction

Raw article text passes to Gemini AI with a structured prompt:

- Input: Article URLs and full text from TechCrunch.

- AI task: Identify companies announcing new funding rounds.

Output format:

- Company name

- Investment purpose ("AI development," "market expansion," "hiring 30 engineers")

- Source URL

The "Investment purpose" field is critical for lead qualification—knowing a company "raised $10M to build autonomous construction robots" tells you everything about fit if you're a robotics investor. This context transforms funding opportunity announcements into actionable investment opportunities.

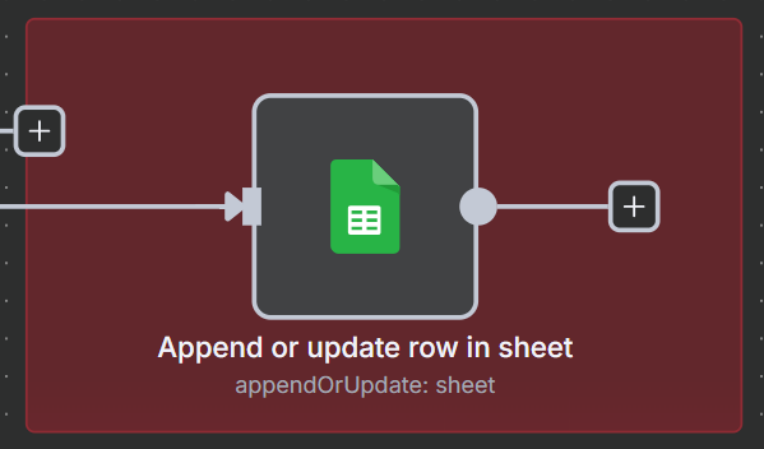

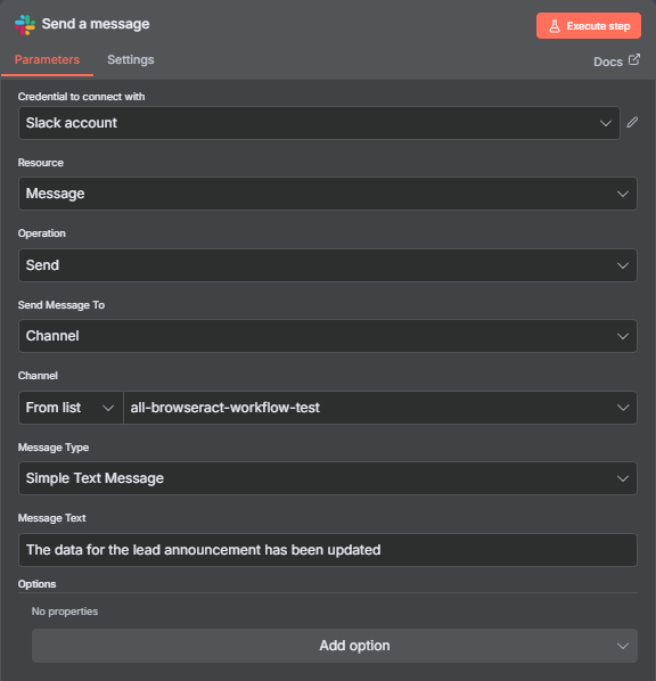

Stage 4: Export and Real-Time Alerts

Valid results flow through two final steps:

- Data formatting: JavaScript node converts AI output into structured rows—one company per entry.

- Conditional logic: IF node validates results (Company ≠ "No Company") before export.

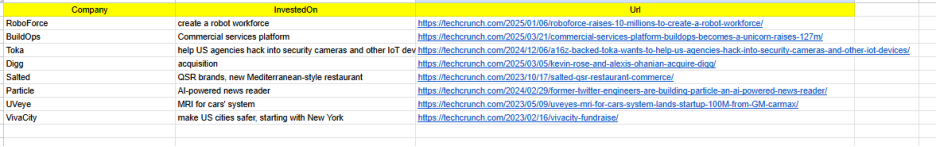

Google Sheets export: Three columns automatically updated 4x daily:

- Company name

- Investment purpose

- TechCrunch article link

Real-time alerts when new investment opportunities are discovered. After 30 days of 4x daily runs, you'll have 300-500 qualified investment opportunities—more deal flow than most solo investors see annually through conferences and referrals.

Sample Result (more info in our Discord):

Click to start our workflow guidance:

Ready to start now?

Why You Should Find Recently Funded Startups Early

First Access to High-Quality Deal Flow

For VCs, timing determines whether you get a meeting or get ignored. The numbers are brutal: reach out within 6 hours and you get 40-50% response rates. Wait until day 3 when Crunchbase publishes the news? Response rates drop to 5% or less as your email gets buried under 100+ identical messages.

When you're the second or third investor to reach out (not the 50th), founders actually remember your name. They see you as plugged-in and proactive. Early discovery also reveals patterns before the market does—when you notice three climate tech startups raise seed funding in the same week, you're spotting an emerging trend while other VCs are still analyzing last quarter's data.

Catch Startups in Active Growth Mode

For sales teams, recently funded startups are the highest-intent leads you'll ever find. They literally just announced: "We have money and we're ready to spend it on growth."

They're hiring aggressively, scaling infrastructure, upgrading their CRM, buying sales automation tools. This isn't theoretical spending—it's happening right now with actual budget allocated. Contact them on day 1 and you're a helpful resource. Contact them on day 30 and they've already signed with your competitors. Sales cycles with recently funded startups are 3-5x faster because urgency is built into their growth plan.

Build Market Intelligence Before Competitors

For researchers, finding recently funded startups early reveals trends before they become obvious. Early detection gives you a 2-3 month head start on market analysis—you spot emerging categories and see which business models attract capital before this becomes common knowledge.

When you track 300-500 recently funded startups per month instead of 30-50 found manually, you see patterns others miss. By the time competitors read about trends in Gartner reports 6 months later, you've already analyzed the space, talked to founders, and positioned accordingly.

Less Noise, Better Relationships

Here's what happened after a funding announcement:

- Hour 0-6: Founders receive 3-5 thoughtful messages. They respond to most.

- Hour 24: They receive 20-30 messages and feel overwhelmed.

- Hour 72: They receive 100+ generic messages and stop reading entirely.

The difference between being message #3 and message #103 is the difference between a 40% response rate and <1%. When you find recently funded startups within 6 hours, your message gets read, your outreach seems timely, and you're building relationships from credibility instead of looking like you're scraping databases.

Who Needs a Recently Funded Startups Tracker: Find Your Use Case

Venture Capitalists & Angel Investors

You're constantly searching for investment opportunities, but deal flow arrives too late. By the time you see a startup on Crunchbase, 50 other VCs have already reached out. The firms that consistently get into competitive rounds aren't smarter—they're just faster at finding newly funded companies before the feeding frenzy begins.

This automated startup funding tracker changes that dynamic. Instead of learning about a promising fintech startup three days after their Series A when investors have already requested meetings, you get an alert within hours. You can send a thoughtful message while the founder is still reading congratulations notes, not drowning in template emails. That early contact positions you as someone with their finger on the pulse, someone who notices funding rounds before they become obvious.

Early detection also reveals investment patterns others miss. When you notice four logistics startups raised seed funding in the same month, all focusing on last-mile delivery automation, you're seeing a trend in real-time. By the time industry reports confirm this as "an emerging category," you've already evaluated the landscape and potentially made an investment.

Sales Teams & Business Development

You're selling B2B software, consulting services, or enterprise solutions to startups. Your pipeline is full of companies that "might be interested someday," but closing deals takes forever because prospects lack budget. You need deals that actually close this quarter.

Finding recently funded startups solves this problem. When a company announces they raised $8M to "expand the sales team," they have money in the bank and a growth plan approved by investors. If you sell sales enablement tools or CRM systems, they need your solution right now. The budget is allocated, urgency is real, and decision cycles are 3-5x faster than typical enterprise sales.

But timing determines everything. Companies that just raised funding receive 100+ vendor messages within 72 hours. By day three, founders stop responding to cold emails entirely. This workflow helps you track startup funding announcements in real-time, so you're reaching out within hours when response rates are 40-50%, not days later when they've dropped to 5%.

While competitors cold call random companies hoping to find budget, you're talking to founders who literally just announced their spending plans. That's the difference between hoping for deals and engineering your pipeline around companies actively looking to buy.

Market Researchers & Analysts

You're tracking industry trends or competitive landscapes for clients or internal strategy. Your insights are only valuable if they're early and accurate, but by the time funding data appears in standard databases, the market already knows. You need to identify trends before they hit mainstream tech media.

Traditional approaches to monitoring startup funding activity are too slow. Crunchbase lags by days. LinkedIn posts are inconsistent. By the time you manually compile a list of recently funded companies in a sector, the opportunity for unique insights has passed.

This automated workflow monitors multiple sources simultaneously and alerts you within hours. When you notice eight DevOps startups raised seed funding for Kubernetes optimization in 60 days, you're predicting a trend, not reporting one. You can publish analysis or brief clients based on real-time funding patterns while competitors wait for quarterly reports.

When you systematically track startup funding across sectors, you build proprietary datasets revealing which technologies attract capital, which business models investors believe in, and which geographies are heating up. You're answering "where is smart money flowing?" before the market even asks.

Recruiters & Talent Acquisition Specialists

You're placing executives or engineers at high-growth startups, and your business depends on speed. The best opportunities come from finding newly funded startups before they post jobs publicly. When a SaaS company raises $10M Series A to "build out the sales organization," you know they need 5-10 sales reps and a VP of Sales—from the funding announcement, not a job board three weeks later.

This workflow helps you discover startup funding news the moment it's announced. While other recruiters wait for job postings on AngelList, you're already talking to hiring managers about roles they're planning to fill. You're not competing for publicly listed positions—you're helping define them. That turns you from a vendor into a trusted advisor.

When a hot AI startup announces funding, every technical recruiter will call them within a week. But if you're calling within 24 hours with a thoughtful message about similar placements, you're the one who gets the exclusive relationship. In a market where the best candidates get multiple offers, being the recruiter who brings opportunities first makes all the difference.

Corporate Innovation & Strategy Teams

You're scouting acquisition targets, partnership opportunities, or competitive threats for a larger company. Your job is knowing what's happening before it disrupts your business, but by the time a startup appears on your radar through traditional channels, they've already secured multiple funding rounds.

Finding recently funded startups early gives you strategic options that disappear if you wait. A seed-stage company that just raised $2M might be open to partnership or acquisition conversations—but only before they raise Series B and decide to compete directly. The difference between engaging at $2M valuation versus $50M isn't just price—it's whether the conversation happens at all.

This automated startup funding tracker helps you monitor competitive landscapes in real-time. Filter for specific sectors or technologies and receive alerts whenever relevant companies raise capital. When a competitor raises $20M, you know immediately and can brief leadership before your next board meeting.

Systematically tracking which startups get funded, by whom, and for what purpose gives you a real-time map of where innovation is happening in your industry. You're not reacting to disruption—you're anticipating it quarters in advance, creating time to build, partner, acquire, or adapt before competitive threats materialize.

What to Evaluate Once You Find Funding Opportunities

Finding recently funded startups early gives you a critical advantage: time to conduct thorough evaluation before competitive pressure forces rushed decisions. Focus your assessment on three key criteria that separate strong investments from weak ones.

Look for innovation and defensibility—startups with sustainable competitive advantages through proprietary technology, network effects, or regulatory moats. Funding announcements often reveal why investors backed a company, giving you initial signals about defensibility before deeper diligence.

Assess market traction and validation through revenue growth, user adoption, and retention metrics that companies typically share in funding announcements. A startup announcing "$5M seed round after growing 300% year-over-year" has demonstrated product-market fit worth investigating further.

Evaluate team quality and execution capability by speaking with founders early, before they're inundated with investor calls. Your 24-hour first-mover advantage creates opportunities for authentic conversations where you can assess how founders think about their market, acknowledge risks, and articulate competitive advantages—qualitative signals that matter as much as metrics at early stages.

Conclusion: Automate Your Recently Funded Companies Discovery

Manual searches for "recently funded startups" and "startup funding announcements" waste hours while delivering outdated results. By the time you discover companies that just raised money, your competitors have already made contact.

This automated startup funding tracker changes everything. Monitor funding news 24/7, receive real-time alerts when startups raise capital, and access investment opportunities within hours—not days—of announcements.

Ready to discover investment opportunities before anyone else?

Relative Resources

How to Find Best Selling Products on Amazon in 2025

How to Scrape Google News via No-Code News Scraper

Why Use a Reddit Scraper? 12 Reasons for Market Intelligence

How to Find Leads on Yellow Pages For Your Business with BrowserAct

Latest Resources

Moltbook: Where 150K AI Agents Talk Behind Our Backs

How to Bypass CAPTCHA in 2026: Complete Guide & Solutions

Moltbot (Clawdbot) Security Guide for Self-Hosted AI Setup